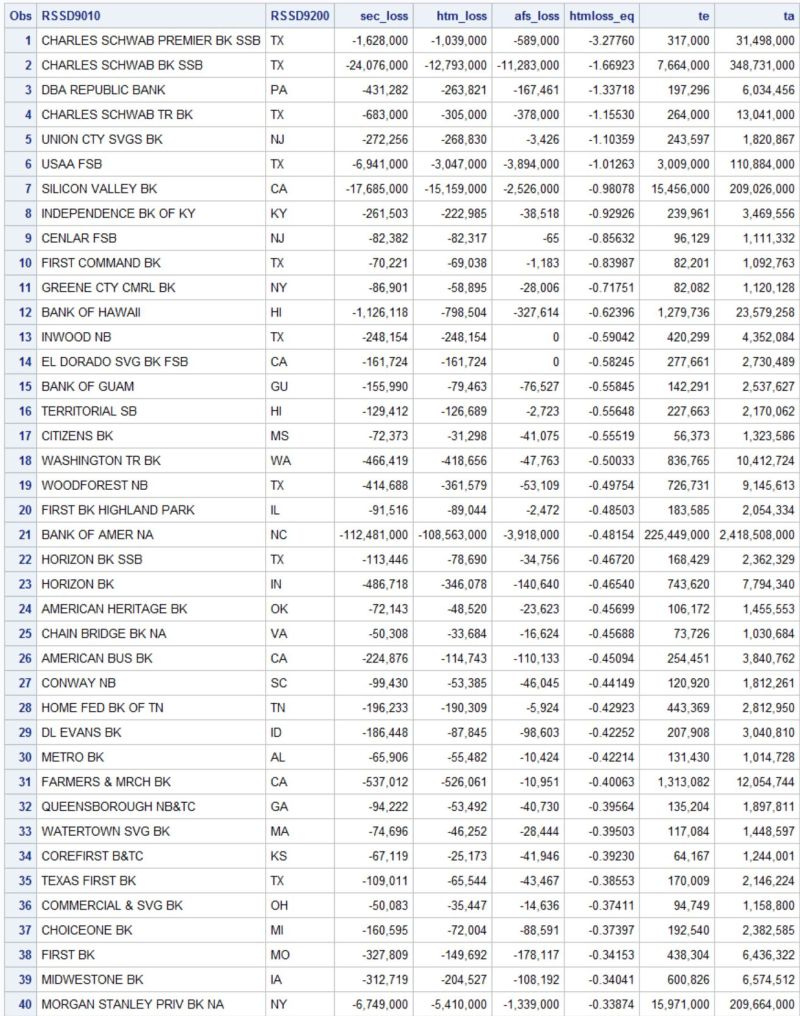

Full List Of Banks At Risk Of Failure Based On Deposit Base And HTM Losses (Which Killed SVB & SBNY)

Here is a list of the banks most at risk of failure based on deposit base and HTM losses on books.

This is a screen based on Q4 data which calculates unbooked losses on securities and compares that to total equity for a firm. For example there are six banks where unbooked losses exceed equity including Charles Schwab. As you can see SVB wasn’t even the worst bank here in terms of hold to maturity losses relative to equity which is quite scary to be honest.

The Htmloss_EQ shows the amount of HTM losses relative to equity. So for Charles Schwab Premier BK SSB Bank the HTM losses are 3.2X more than value of equity.

Hold to maturity losses in combination with a deposit base that is 93% above the 250K FDIC threshold is what brought down SVB. The losses are not included in earnings statements and therefore not widely known to the public due to accounting rules. To explain this complicated accounting rule simply, if you buy an asset as a firm you have to report the value of that asset as the price you paid for it. So if I'm company X and I buy a property for $1M I must report that $1M purchase price as the current value of that asset even if the value of that asset has changed (appreciated or depreciated). The same is true with bonds, in this case many of these banks bought bonds that have gone down massively in value, but aren't being shown as losses yet based on this accounting principle which requires firm to report what they paid for an asset not what its worth.

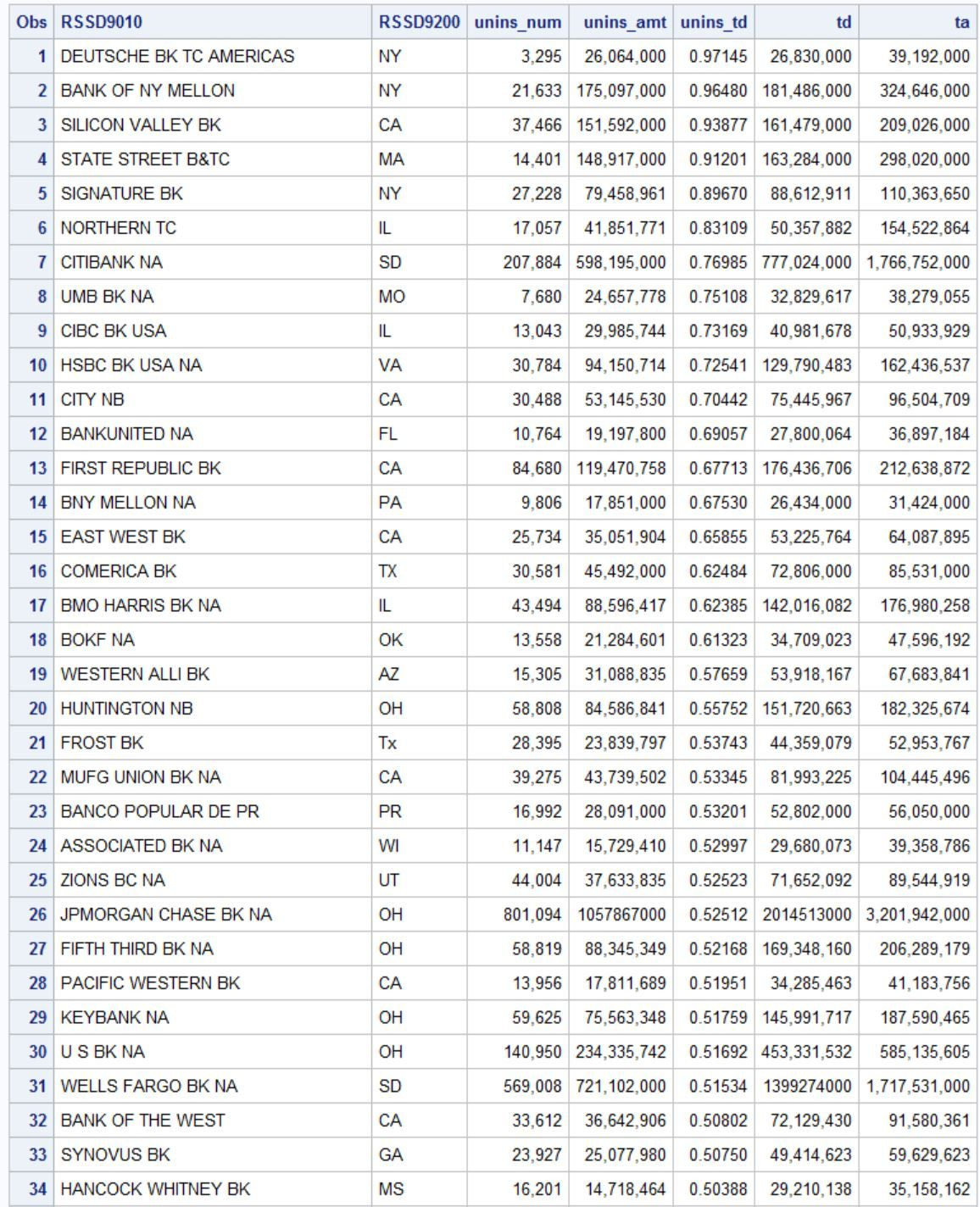

The below list shows what banks have the largest exposure to uninsured deposits. As you can see SVB was $3 on this list and SIgnature bank was $5 on this list, given both banks have failed last week this is not good company to be in. The sixth column is the % of depositors which are uninsured. So for example you can see SVB depositors were 93% uninsured.

Full Explanation Video -

Its really easy to sit back and say, its just the banking sector having issues BUY TECH! But the banking industry is the only industry that touches all other sectors. If you want any funding in any type of business you must rely on the banks one way or another. This is important, keep your eye on these two lists which can be found via linked in using the below link.

https://docs.google.com/spreadsheets/d/10kCJsCYsC00uIESD5WyxRmXXJxaRHrQX3O2Zmevm_1Y/edit#gid=438114470